The prices of terrace homes will appreciate in 2024 while detached houses are expected to continue their decline, according to the inaugural Malaysian House Price Index (MHPI) released today. — Picture by Miera Zulyana

Wednesday, 07 Feb 2024 8:30 PM MYT

KUALA LUMPUR, Feb 7 — The prices of terrace homes will appreciate in 2024 while detached houses are expected to continue their decline, according to the inaugural Malaysian House Price Index (MHPI) released today.

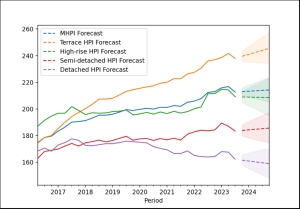

The Centre for Real Estate Research with the Faculty of Built Environment of Tunku Abdul Rahman University of Management and Technology (TAR UMT) forecast in the index that terrace homes would be the best performing of the four residential home types, with a predicted annual growth of 2.77 per cent.

The report said that the value of terrace homes is expected to appreciate about as much as the long-term inflation rate of 3.0 per cent, providing a buffer against rising prices. Semi-detached and high-rise home values are predicted to grow at around 0.57 per cent and 0.45 per cent, respectively.

However, detached home values are predicted to decline by -1.62 per cent. The finding was reached using the autoregressive integrated moving average (ARIMA) forecasting technique, which predicts future values based on past values.

Overall, the report predicted the MHPI to be on an uptrend, with a moderately positive annual growth of 0.64 per cent for 2024.

“The housing market remains a complex and dynamic landscape. We believe this forecast information will empower home buyers and sellers to navigate the market with confidence, investors to make strategic choices, and policymakers to develop informed housing initiatives.

“HPI forecasts could aid policymakers to make informed decisions by adjusting interest rates, introducing tax incentives, providing new regulations and implementing targeted interventions based on projected market trends,” said Prof Ting Kien Hwa, the adviser for the centre.

He said that consistent and foreseeable movements in the HPI are vital for financial stability overall. Conversely, sudden and extreme fluctuations can create ripple effects impacting financial institutions, businesses, and individuals alike

“The forecasts when carried out over a full property market cycle will provide warning signs for example, a rapid rise in the HPI might indicate an unsustainable bubble, while a sharp decline could signal a recession,” said Assoc Prof Cheng Chin Tiong, head of the Centre for Real Estate Research, TAR UMT.