KUALA LUMPUR (Dec 26): Penang-based electronics manufacturing services provider NationGate Holdings Bhd (KL:NATGATE) is acquiring Valeo Malaysia CDA Sdn Bhd from French automotive supplier Valeo SE for RM60.89 million in cash.

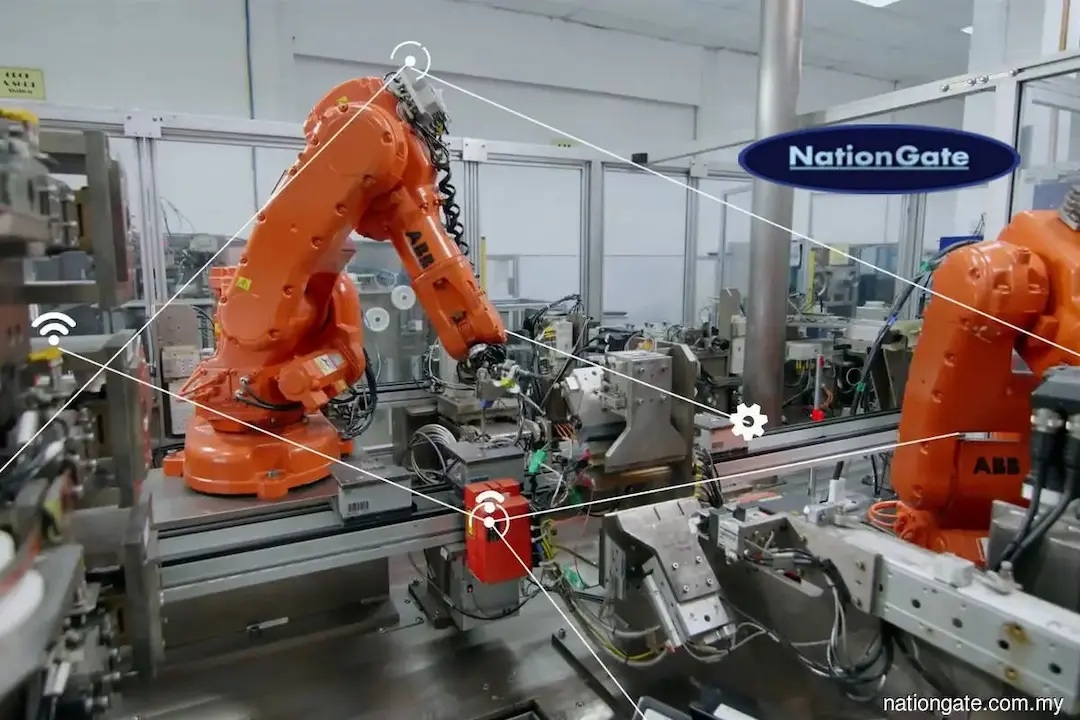

Valeo Malaysia is principally involved in the manufacturing of plastic injection-moulded components, printed circuit board assemblies, final testing and assembly of automotive modules and products.

NationGate said the acquisition is aligned with the group’s strategy to strengthen and expand its core business, while enabling it to broaden its customer base and gain direct access to key automotive end customers.

In a filing with Bursa Malaysia on Friday, NationGate said its indirect wholly owned subsidiary NationGate System Sdn Bhd had on Thursday (Dec 24) entered into a sale and purchase agreement with Valeo to acquire 100% equity interest, comprising 168.2 million shares, in Valeo Malaysia.

“The acquisition is expected to deliver synergistic benefits through improved cost efficiencies, streamlined integration, optimised production processes and more effective utilisation of shared resources,” NationGate said.

While the immediate impact on profitability cannot be precisely quantified due to prevailing market and economic conditions, the group expects the acquisition to contribute positively to its financial performance and long-term growth prospects.

Valeo Malaysia also owns two leasehold parcels of land with a factory building located in Seberang Perai Tengah, Penang, which will further enhance NationGate’s manufacturing footprint.

For the financial year ended Dec 31, 2024, Valeo Malaysia recorded a net loss of RM1.96 million, with net assets of RM18.45 million. However, for the period from Jan 1, 2025 to April 30, 2025, the company posted a net profit of RM4.35 million, while net assets rose to RM22.79 million.

Upon completion, Valeo Malaysia will become an indirect wholly owned subsidiary of NationGate. The acquisition does not require shareholder or regulatory approval and is expected to be completed by Dec 31, 2025.

At the midday market break on Friday, NationGate shares fell one sen, or 1.01%, to 98.5 sen, giving the group a market capitalisation of RM2.23 billion. The stock has declined 62.12% year to date.